Partners Life

Evince

Making life insurance advice a conversation through storytelling and smart data.

Insight

The life insurance process can be daunting and is resisted by many.

Life insurance can feel like a daunting purchase, a complicated process perceived as having little material benefit, at least in the immediate term. It’s a perception that causes many New Zealanders to avoid it, making New Zealand one of the most underinsured countries in the developed world.

Idea

Helping customers see their future financial self.

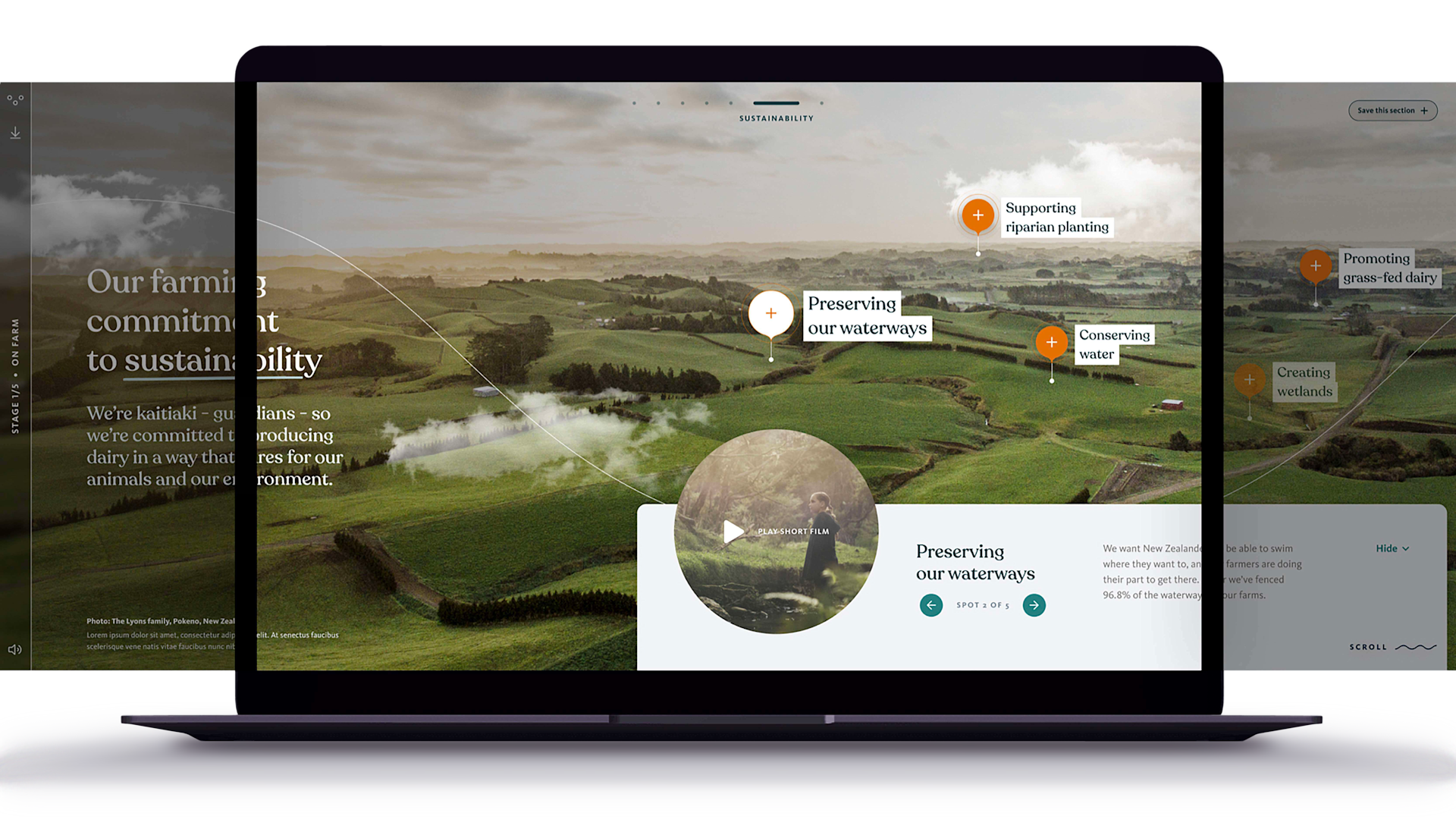

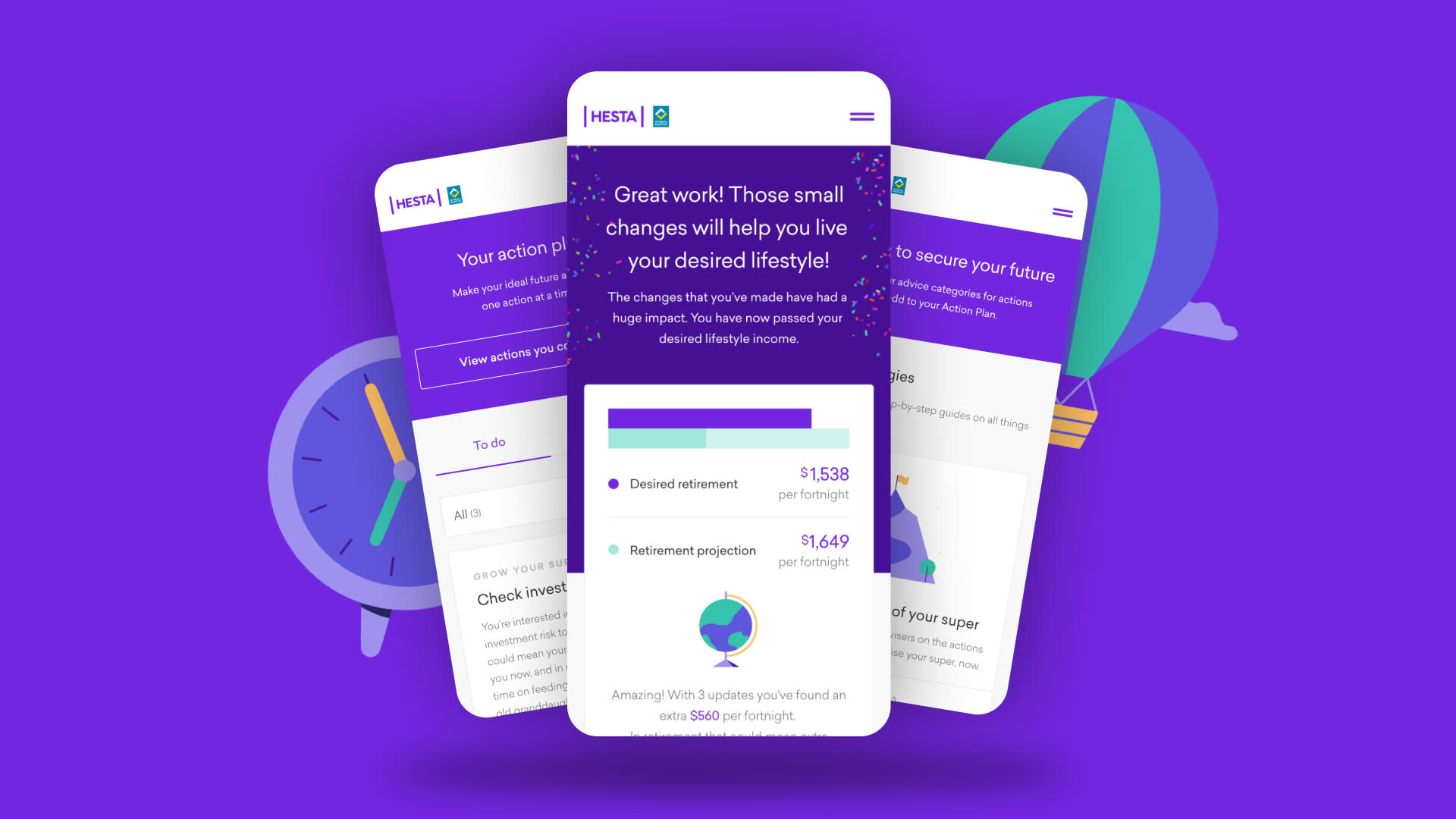

Evince is a visual and interactive advice tool, designed to help customers understand their need for insurance, based on their personal level of risk. Evince is a single tool, with multiple scenarios and parts of the experience that are accessed directly by the customer. There is the option to have the support and facilitation of an adviser or have an adviser only.

The experience is designed to build a rich and detailed picture of visitors’ financial futures, and it is through this fact-based visual storytelling that customers understand their risks and can seek to take action.

Impact

Along with positive feedback from advisers and customers, Evince has enabled a 61% increase in the inclusion of disability income benefits and a 36% increase in the overall Annual Premium Income.

The use of Evince has reduced the timeframe of the advice process on average from 23 days to 11 days from fact finding to application submission. This was partly enabled by 64% of customers choosing to and successfully completing, the fact finding process independently of an adviser.

Evince provides an easy, accurate and interactive experience for clients. Life before Evince was paper-based with manual calculations so it would take a long time to get recommendations back to clients. Evince delivers on-the-spot analysis and client feedback is always positive, they like how they can visualise the impacts if disaster should strike.